Welcome to the NBN Community Guide!

Israel is a small country, but each and every community has unique characteristics, services, and amenities. Some communities even have special services for Olim, including municipal incentives and Anglo Olim Coordinators. Browse the guide to find the perfect community to fit your needs.

While our community guide primarily focuses on the most popular communities chosen by our NBN Olim, we also have contacts in a much broader range of communities. See our Community Contacts Guide, for a list of people who have volunteered to help introduce you to their communities.

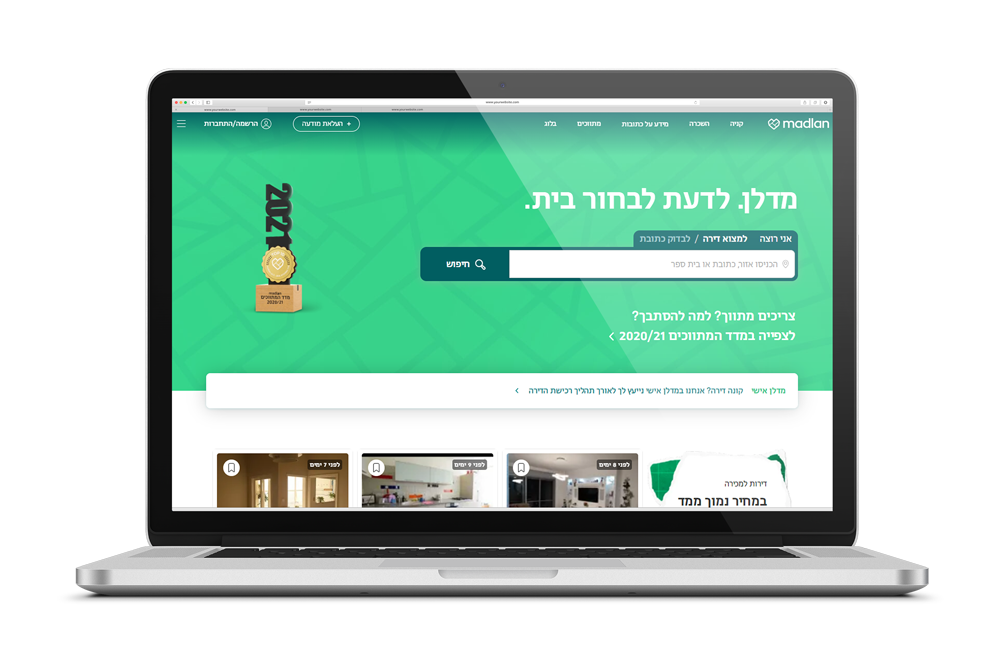

Madlan and Yad2

Yad2 and Madlan are two of Israel’s most popular websites for real estate where you can find both rentals and purchases all over the country. The websites also include information about the communities including demographics, transportation, schools, local amenities, and characteristics of the listed neighborhoods. If you need assistance understanding these websites, please check out our English step by step guides to help you navigate their features and functionality.

Featured Community

Community Directory